Quick guide: Implementing a Delegation of Authority policy

What is Delegation of Authority and why is it important for your business

A Delegation of Authority policy (also known as a DFA or Delegated Financial Authority) is a crucial aspect of any company or organisation’s financial management. It outlines the specific responsibilities and levels of approval required for financial transactions, such as accounts payable. This can include setting threshold limits for expenses, outlining which departments are responsible for certain expenses, and specifying which individuals within the organisation have the authority to approve certain transactions.

Having a well-defined Delegation of Authority policy in place not only helps to streamline the approval process, but also helps to reduce financial risks and ensures that all financial decisions are made in the best interest of the company. Implementing and sticking to this policy can be time-consuming, but the long-term benefits make it worth the effort.

Setting up a Delegation of Authority matrix

Creating a clear and comprehensive Delegation of Authority matrix is essential to the effective implementation of your policy. Here are some steps to guide you in setting up your matrix:

- Identify all of the different levels of authorisation within your organisation, such as line managers, department heads, and the CFO or CEO.

- Set threshold limits for each level of authorisation. For example, invoices under $200 may only require the approval of a line manager, while invoices up to $500 may require the approval of a line manager, department head and the CFO.

- Determine which expenses fall under the responsibility of each department.

- Specify any expenses that require multiple approvals at any level, such as expenses related to a specific project that involve several departments.

- Document everything in a clear and easy-to-read table or flow chart.

- Communicate the newly established policy to all employees involved in the approval process.

By following these steps, you can establish a Delegation of Authority matrix that is tailored to your organisation’s specific needs and ensures that financial decisions are made efficiently and effectively.

Streamlining your approval process with automation

Once your Delegation of Authority policy is in place and all approvers are aware of their responsibilities, it’s important to find a way to make the process run smoothly. A paper-based process can be inefficient, and it only works when the responsible approvers are in the office. It also can be easily lost and not very convenient in the case of distributed offices or remote working scenarios.

While email approvals have their own benefits over paper, someone still needs to route the documents according to the approval matrix, chase up approvers, and take care of sorting and filing throughout the process.

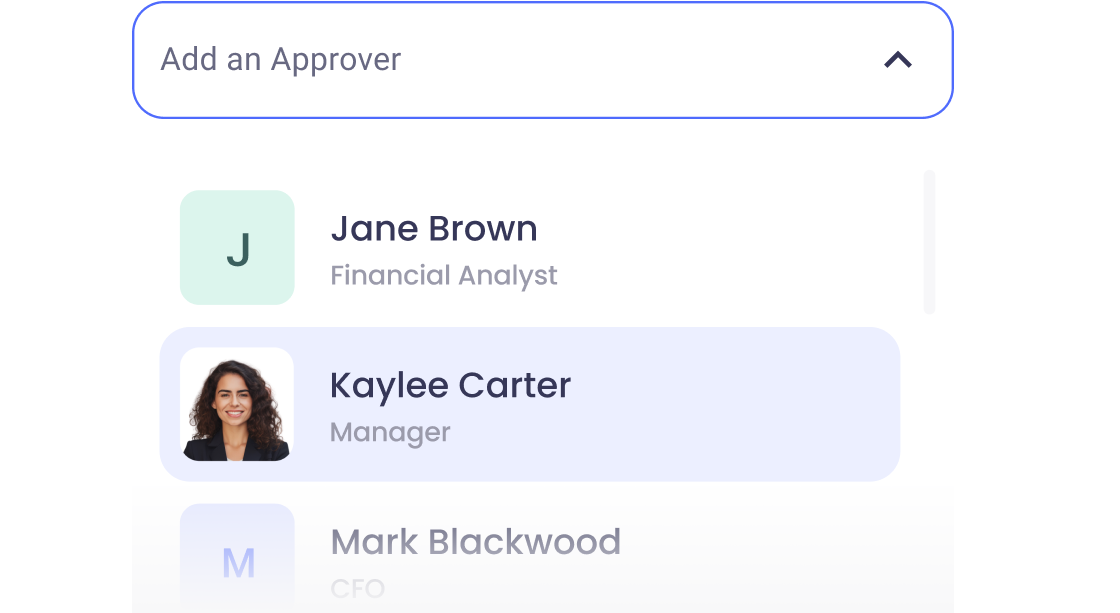

An efficient solution to this problem is to use an approval automation tool such as ApprovalMax. If you are already using Xero or QuickBooks Online, you can simply connect it to ApprovalMax, set up an approval matrix that aligns with your DFA policy, and have everything run smoothly without manual interventions.

Approvers can get automated notifications when there is a document waiting for their decision, and they can even use a mobile app to approve while on the go.

ApprovalMax not only automates your Delegation of Authority policy, but also enables advanced spend control, allowing you to match bills to purchase orders and monitor spend in progress with budget checking and accrual reports.

By using an approval automation tool, you can streamline your approval process, making it more efficient and secure. No more chasing up approvers or losing paper documents. With automation, you can ensure that your Delegation of Authority policy is being followed and that financial decisions are being made in a timely and effective manner.

Advanced spend control with approval automation

With ApprovalMax’s advanced features, you can easily set up checks and balances to ensure that all expenses are properly approved and that any potential issues are identified and addressed quickly. This not only improves the efficiency of the approval process but also helps to reduce the risk of financial mismanagement.

ApprovalMax not only streamlines the approval process but also provides a comprehensive solution for financial oversight. With its ability to streamline the approval process and automatically flag inconsistencies, monitor real-time spending, cross-check spend against the budget, and other dedicated features, it ensures that your DFA policy is being followed and financial decisions are being made in a timely and effective manner.

Putting it all together: Achieving efficient and secure financial approval with a delegation of authority policy

A Delegation of Authority (DFA) policy is an essential aspect of financial management that ensures efficient and effective decision-making while reducing the risk of mismanagement. Establishing a DFA matrix may take some effort, but it can be made simpler by following a few simple steps such as defining all the authorisation levels, amount thresholds, and expenses by departments.

An approval automation tool like ApprovalMax can further simplify the process by streamlining approvals, providing advanced spend control, and ensuring compliance with the DFA policy. Overall, implementing a DFA policy and using an approval automation tool can greatly improve financial management and reduce risks.

Ready to Simplify Your Approval Process?

Approvalmax is an all-in-one B2B software platform used by businesses around the world to build robust AP and AR automation, creating multiple layers of internal control. It streamlines the approval process by allowing users to create automated workflows to approve bills and invoices. ApprovalMax integrates with accounting platforms such as Xero, QuickBooks Online, and Oracle NetSuite to unlock powerful efficiencies for accounts payable and accounts receivable functions in any finance team.

Set up a system of checks and balances for your financial operations.

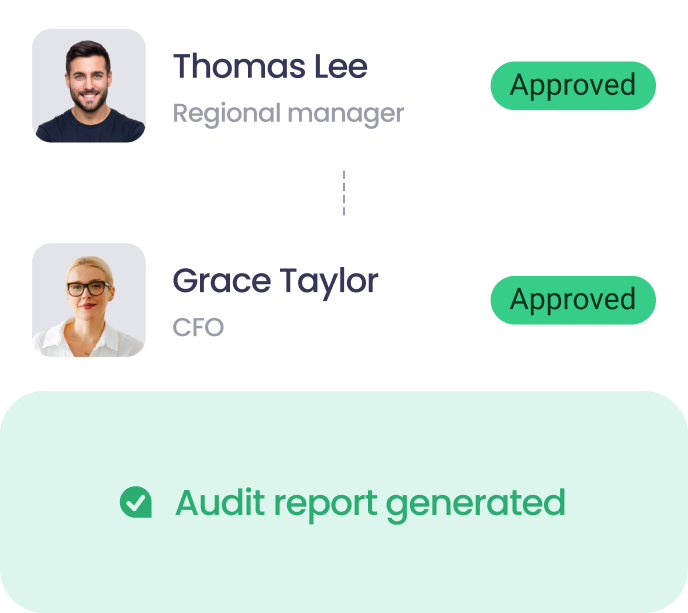

Multi-step, multi-role approval workflows for financial documents.

Auto-generated audit reports for each approved item.

Get alerts for fraudulent activity and protect against it happening.

Leave printing in the past with fully digitised workflows.