Beyond big business: Exploring three use cases for approval automation

Time and time again, I hear from bookkeepers that their clients ‘aren’t big enough’ to need approvals. This type of thinking holds so many businesses – of all sizes – back from experiencing the benefits of strong approvals and tools, like ApprovalMax, that support it.

For far too long, strong financial controls have been seen as the domain of big businesses, those with large finance teams and deep pockets. But financial controls, including approval processes, are needed by businesses of all sizes. Despite this, only one in four businesses has the right controls in place, according to ApprovalMax research.

With my clients, I focus on process efficiency and setting up the structures and systems that work best for their unique business, including building the right cloud-based tech stack. Sometimes, they put this off for far too long; many think they have to get to a certain size before they can use certain software but actually using the software might help them grow.

To give you real-life examples, here are three recent clients I’ve suggested ApprovalMax to, how I suggest they use it, and why:

This local sports club moved to Xero and Dext a few years ago but struggles with controlling spend. The club only has one full time employee and is otherwise supported by a team of volunteers, so it’s important to do more with less.

Although they’re using budgets in Xero, unnecessary costs slip through the cracks and lead to budgets spiralling out of control. Currently, it takes the volunteer treasurer two days per week to manage the finances. With his term finishing up soon, this needs to be streamlined for the next person in the role.

Suggested approach:

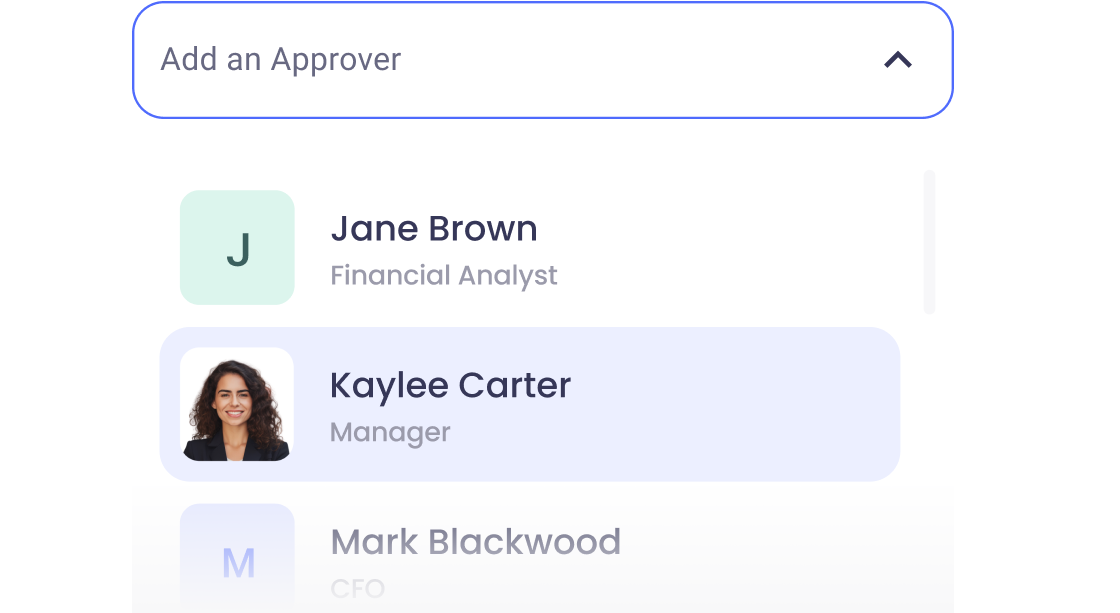

- Start issuing POs via ApprovalMax, which will need to be signed off by the treasurer before issuing and checked against budgets to avoid surprises when final invoices come in.

- Reduce subscriptions by using ApprovalMax Capture to replace Dext when the purchases come in, including bill-to-PO matching, and push bills through approval before payment.

What will ApprovalMax solve?

.webp?width=1248&height=766&name=9018_Component%2062%20(3).webp)

At this fast-moving media agency, the team regularly shares quotes with clients on short notice. Sometimes, this means the quotes don’t go through the right approval process before sending to clients. It can also mean that quotes get lost in emails, or multiple versions are floating around. With an average 200 jobs a year, things get confusing – fast.

The agency also bills for extra time each month. Currently, one junior team member emails each and every client for confirmation before invoicing, then each invoice has to go through the right internal approvals.

Suggested approach:

- Roll out sales quotes using ApprovalMax and Xero to ensure all quotes are correct and checked internally before sending onto each client.

- Swap the POs to go through ApprovalMax so final invoices can be matched with the POs to tie every job up.

- Save time and use ApprovalMax Capture to extract data from ~200 jobs per year, instead of entering invoice details manually.

- Use additional reporting in ApprovalMax to track everything is linked together.

What will ApprovalMax solve?

This client, which admittedly is a relatively large business, already uses an approval automation tool. However, its limitations are seeing the team spend hundreds of pounds in excess fees each month. The firm processes 300 invoices each month with a huge amount of manual workarounds; for example, the tool’s OCR tool takes 24 hours to upload so can’t be used for tight deadlines, meaning they need to be manually input or circulated via email.

Bills get stuck in the queue and far too often the team follows up via email since few team members actively check the current tool. All of this results in wasted time and resources, for both approvers and accounting staff.

Suggested approach:

- For continuity around controls, replace the current system with ApprovalMax and get all approvers to download the app.

- Build workflows for regular suppliers so they filter automatically and encourage the internal team to make comments directly in ApprovalMax.

- Build email rules on the accounts inbox and supplier rules in Dext to import bills faster.

What will ApprovalMax solve?

Getting started

Ready to Simplify Your Approval Process?

Lara Manton has over a decade of experience running LJM Bookkeeping Ltd. Recognised with awards like ICB Small Practice of the Year 2021 and Xero Innovative Partner of the Year 2023, she brings a tech-savvy, bookkeeper-focused perspective to every project.

Set up a system of checks and balances for your financial operations.

Multi-step, multi-role approval workflows for financial documents.

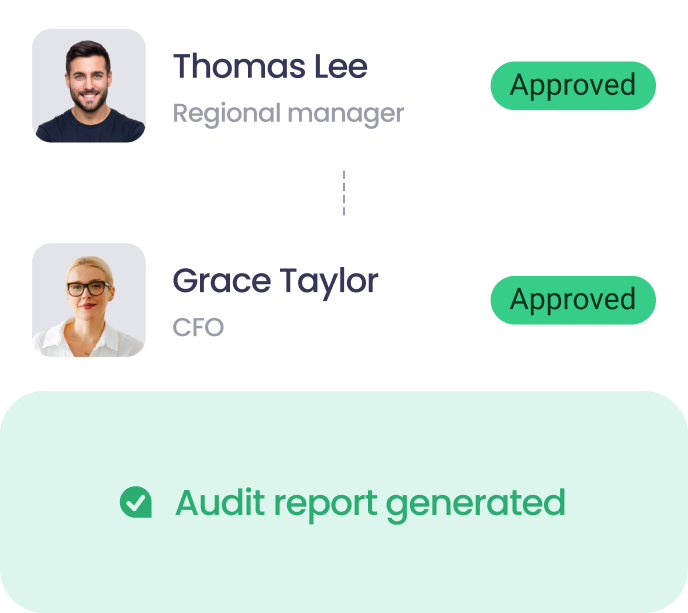

Auto-generated audit reports for each approved item.

Get alerts for fraudulent activity and protect against it happening.

Leave printing in the past with fully digitised workflows.

.webp?width=350&height=222&name=photo%20placeholder%20(7).webp)