Five reasons to never chase finance approvals again

As businesses grow, they can benefit from strengthening financial controls and approvals to prevent, detect, and correct any financial issues before they arise.

What would happen if you never had to chase down approvals for financial documents, like POs and invoices, again? For finance professionals, approvals can take up huge amounts of time and cause issues that hinder efficiency and results.

Think about the journey of an incoming invoice that needs to be paid. There are usually a few steps: the invoice gets sent to the main contact, emailed to the first approver, goes through any extra approval layers, and finally goes to finance for processing into QuickBooks Online.

This should be simple, but far too often it’s not. Invoices get buried in email inboxes, approvers go away unexpectedly, or documents just get missed. Whether you manage approvals through email, workplace messaging, or spreadsheets, the main issue remains the same: manual processes are unreliable and time-intensive.

The hidden costs of manual approval processes

Manual approval processes drain resources that could be better spent on strategic planning and decision-making. When your team spends hours each week tracking down approvals and following up on outstanding tasks, that time isn’t free for driving business growth or focusing on financial outcomes.

CHARITYacCOUNTS!, an accounting firm supporting nonprofit organizations, knows this challenge well. Before setting up automated approval workflows for clients, their processes required physical document handling and lots of email coordination. This email-based approach created inefficiencies.

"When you have to email a document, get it signed, then import a PDF into QuickBooks, it’s very time-consuming," said Stephanie Cooper, controller at CHARITYacCOUNTS!. The firm now saves an average of 3.8 days per client each month by automating these approval processes.

5 key reasons to automate approvals

Finance teams are under pressure to do more with less. Freeing up time is essential as economic conditions shift and compliance challenges grow. Automated approval systems get rid of the need for follow-up emails and repetitive admin work so teams can focus on forecasting, budgeting, and other high-impact tasks.

With manual processes, it’s hard to see where documents are in the approval chain. Automated systems give you full visibility to spot hold-ups and better plan for and manage cash flow.

Time is essential in financial processes. Automated systems such as ApprovalMax can approve 25% of bills within two hours and 50% within one day. Faster approvals mean quicker data entry, helping maintain up-to-date records without last-minute scrambles.

Errors from manual processes, such as duplicate payments or missed discrepancies, add up fast. Automated systems validate data and detect duplicates so only accurate, approved documents go into your general ledger.

Financial fraud is on the rise, and traditional manual processes often lack the tools to prevent it. Automated systems use advanced detection to flag unusual activity, suspicious documents, or irregular patterns, giving your organization an extra layer of protection.

Building processes that keep pace with your business

Growing businesses need approval processes that scale. Manual systems become unruly the bigger your company gets, with more transactions and people involved. Automated workflows, on the other hand, maintain efficiency and consistency no matter the size.

Finance professionals who use automated approval systems report gains in efficiency, compliance, and team satisfaction. With less time spent chasing approvals, you can focus on strategic initiatives that shift the dial.

A world without chasing approvals means faster, more efficient financial operations for your entire team. The technology to make this a reality is already here.

Want to explore how ApprovalMax integrates with QuickBooks Online to automate your approval workflows? Start a trial today.

Ready to simplify your approval process?

Matt Lowry is the chief revenue officer at ApprovalMax. With deep experience in technology for businesses and accountants, Matt is focused on driving efficiency and delivering results.

Set up a system of checks and balances for your financial operations.

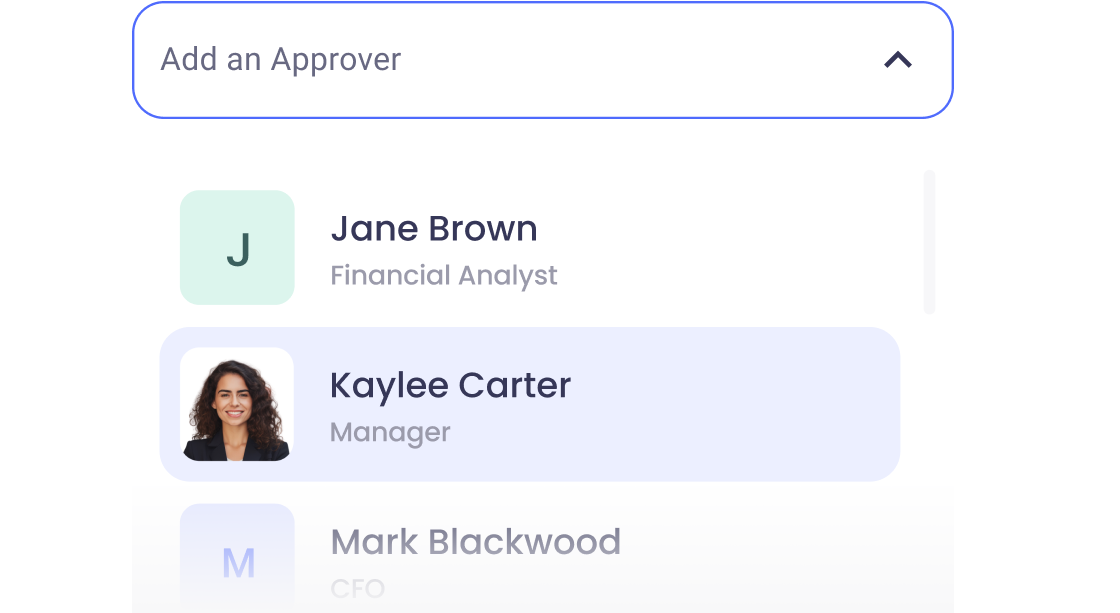

Multi-step, multi-role approval workflows for financial documents.

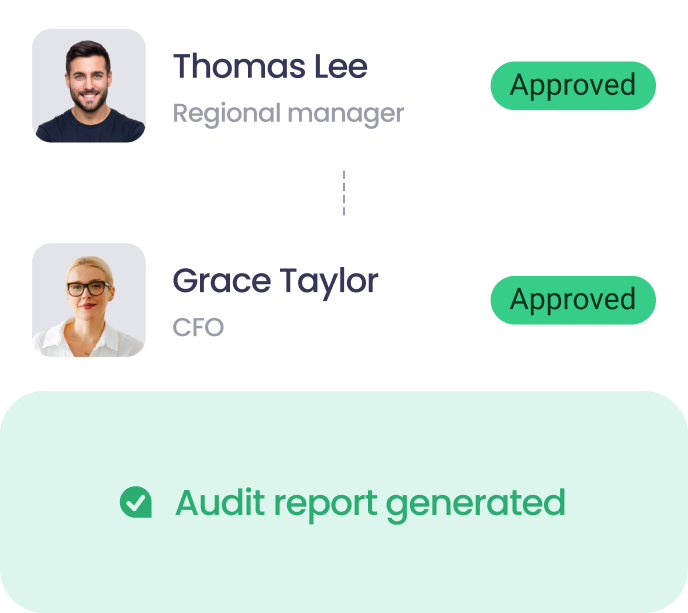

Auto-generated audit reports for each approved item.

Get alerts for fraudulent activity and protect against it happening.

Leave printing in the past with fully digitised workflows.

.webp?width=350&height=222&name=photo%20placeholder%20(7).webp)