Accounts payable vendor management: How automation helps

Manual accounts payable (AP) processes do more than just slow you down; they make vendor management more complicated than it needs to be. And as your vendor list grows, the harder it gets to stay on top of payments.

If you’re constantly chasing approvals, fixing mistakes, and keeping track of who’s been paid, it might be time to automate your accounts payable vendor management.

According to Deloitte, automating the AP process helps businesses reduce errors, speed up approvals, and gain real-time insights into financial performance.

In this guide, we’ll cover everything you need to know about accounts payable vendor management, including:

- What it is and how it works

- Why it matters for your business

- The challenges and benefits

- How to choose the right tool

What is accounts payable vendor management?

Accounts payable vendor management is a great way to keep supplier payments organised and efficient. It covers everything from bringing new vendors onboard to tracking payments and making sure vendors are paid on time.

Get started in just six simple steps:

- Find: Choose the right vendor for you, based on factors like pricing and services.

- Negotiate: Agree on terms and easily sign agreements with vendors.

- Onboard: Easily collect vendor details, verify information and keep records up to date.

- Order: Set up a purchase order process to make sure you’re aligned with your vendors from the start.

- Process: Review, match, and approve invoices efficiently to avoid delays and ensure accuracy.

- Pay: Schedule and process payments using secure approval workflows and integrated payment systems.

Automating this process doesn’t just save time. It helps you grow and build stronger relationships with your vendors.

Why does vendor management matter for your business?

Suppliers keep your business running, but only if they're paid properly and on time. Missed payments can lead to delayed orders and damaged vendor relationships that are ultimately bad for business.

That’s why vendor management shouldn’t be just another admin task – it’s a big part of keeping your finance team organised and your business running smoothly. Automating the process helps you stay on top of spending, avoid any payment surprises, and maintain good relationships with your suppliers.

It’s also your first line of defence against fraud. Manual processes are more easily taken advantage of by cybercriminals and scammers. This risk is only growing as they use emerging technologies, like AI, to create convincing fake invoices and payment requests in just seconds.

As technology changes, your processes need to too. Manual AP processes are an increasingly vulnerable target without the right safeguards, but with AP automation you can:

- Centralise vendor details and payment history

- Check every invoice for accuracy

- Approve and pay invoices faster

- Build a reputation as a reliable business partner

- Prevent fraud with verification and approval workflows

Common challenges in vendor management and how AP automation helps

For accountants and bookkeepers

Manual data entry and invoice errors

Picture this: Your team is manually typing invoice data line by line. It’s not just slow – it’s easy to miss a number, double up on a payment, or miscode an amount. These small mistakes quickly become bigger issues.

With automation, invoice data is captured straight from the document, reducing errors and speeding up the entire process.

Late payments and strained relationships

Approvals getting lost in inboxes? Vendors chasing you for updates? When invoices aren’t approved on time, payments get delayed, and vendor relationships can suffer as a result.

Automated workflows send invoices to the right person immediately – with reminders to keep things moving. The result? Happier vendors and fewer last-minute changes.

Fraud risks and compliance gaps

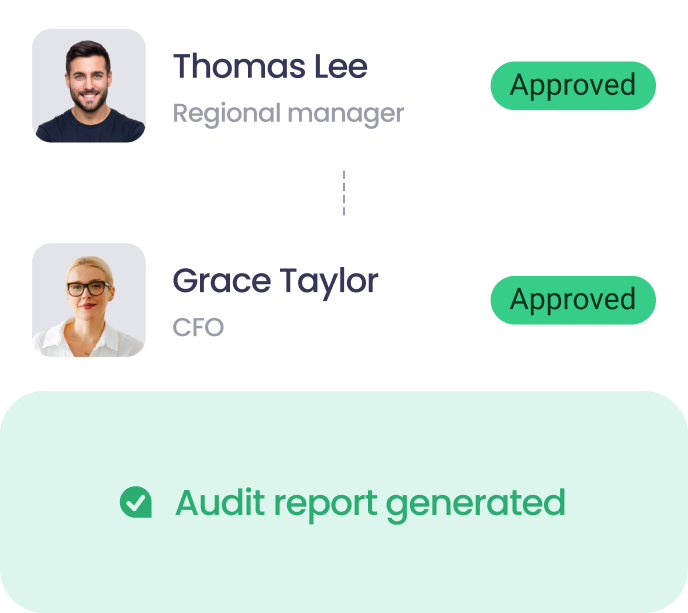

Fraudulent invoices can slip through the cracks without proper processes. And audits become even more stressful when there’s no clear record of who approved what.

Automating accounts payable vendor management adds built-in checks like approvals, audit trails, and user permissions. This means fewer surprises, better visibility, and more control over your payments.

For business owners

Slow, inconsistent vendor onboarding

Managing vendor bank details, reviewing tax forms, and keeping records up to date can be time-consuming. Managing vendor bank details, reviewing tax forms, and keeping records up to date can be time-consuming. On top of this, manual onboarding opens the door to fraud.

According to the 2025 AFP Payments Fraud and Control Survey, business email compromise was the number one attempted and actual avenue for payments fraud, reported by 63% of respondents. This is where fraudsters actively impersonate employees and vendors through sophisticated schemes.

Automating the vendor onboarding process keeps everything in one place and protects against fraud.

Self-service vendor portals for onboarding

Vendor onboarding is also much easier with self-service portals. These portals allow suppliers to enter their details, upload documents, and make updates as needed so your team doesn’t need to chase down information and manually update data.

High processing costs and inefficiencies

Every manual task adds up, from chasing approvals to updating invoice details. That’s time and money your team could be spending elsewhere.

AP automation cuts out the repetitive admin. Approvals move faster, errors reduce, and your finance team has more time for the work that drives value.

Benefits of AP automation for vendor management

The results of automating vendor management go way beyond simply saving time. It helps teams work smarter, enhance security, stay in control, and build trust with suppliers at every step.

Streamlined vendor setup and approval

With automation, you can create tailored approval paths for different types of vendors. Your high-value suppliers can automatically require additional approvals, while everyday vendors follow standard processes. This ensures the right people review each relationship without the manual work of routing requests.

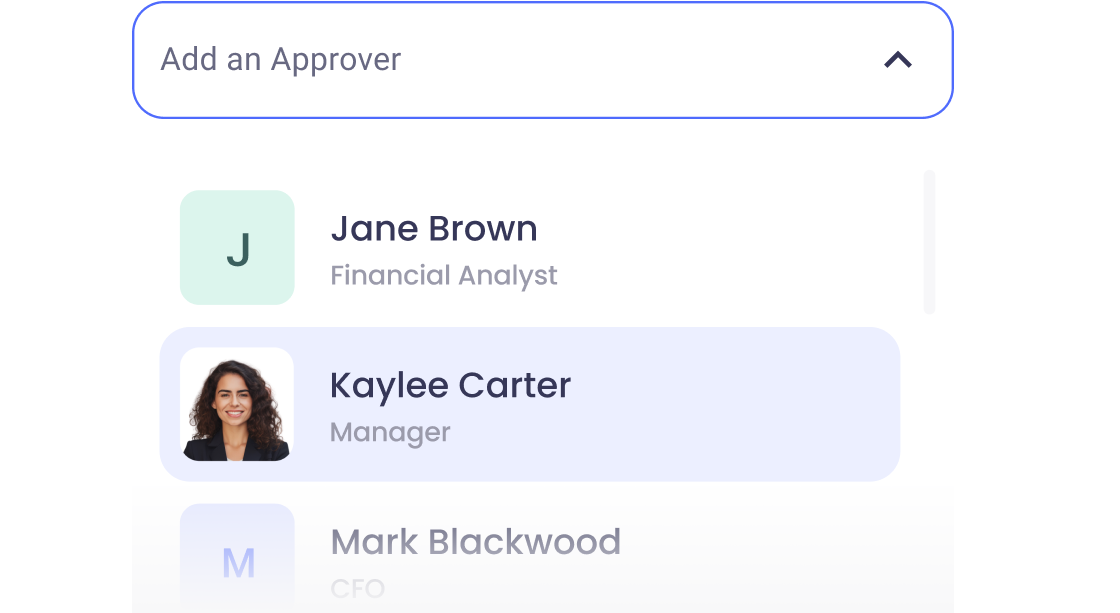

Smart approval routing

With automated vendor management, invoices are directed to the right approvers based on department, amount, or vendor category. When someone goes on leave, the system automatically redirects approvals to designated backups, preventing invoices from getting stuck in an absent colleague's inbox.

Vendor relationship intelligence

Get immediate visibility into payment history, contract terms, and communication logs all in one place. Your team can quickly answer vendor inquiries with accurate information without searching through scattered files, emails, and systems. This creates more efficient interactions and builds stronger supplier relationships.

Risk monitoring and compliance

Set up automatic alerts for expiring vendor documentation, unusual activity patterns, or missing compliance requirements. The system identifies potential issues early, helping you prevent fraud attempts and maintain proper documentation without constant manual review and follow-up.

How to choose the right accounts payable tool for vendor management

Choosing the right AP platform is crucial for managing vendor relationships and making hassle-free payments.

Here are some important features to consider when picking accounts payable software for managing vendors.

Integration with ERP and accounting software

Look for platforms that connect with your preferred ERP and accounting software tools, like QuickBooks, Xero, or NetSuite. This allows you to sync data across platforms so you don’t need to double handle data.

Multi-currency and global payment capabilities

Are you working with international vendors? Choose an AP platform that supports multiple currencies and payment types. Whether it’s GBP, USD, or EUR, having the flexibility to pay in different currencies helps you stay competitive.

Centralised vendor management

Keep all vendor details in one place, from payment history to contracts and contact information. A centralised system makes vendor communication easier and creates smooth operations. This approach improves visibility and guarantees vendors are managed efficiently.

Invoice capture and processing

There’s no need to waste time on manual data entry. Instead, look for a system that captures invoice details automatically, reducing the risk of errors and delays. AI-powered tools provide accuracy by matching invoices with purchase orders. They can also flag discrepancies and reduce processing times.

Custom approval workflows

Set up approval rules that match your business needs. The right AP system will route invoices to the right people instantly, speeding up approvals and keeping things moving. Automated workflows enable approvers review and approve invoices from anywhere. This prevents delays and missed deadlines.

Payment authorisation and execution

Avoid late payments and security risks by choosing an AP system that automates and schedules payments. Vendors appreciate reliability, and automated payments make sure they get paid on time, every time.

Analytics and reporting

Make smarter financial decisions with real-time reporting. Look for a platform that allows you to track vendor payment trends, monitor cash flow, and spot opportunities to save money. Automated reporting helps finance teams optimise cash flow and make informed financial decisions.

Real results: How we helped illumin speed up approvals by 50%

Advertising platform illumin faced a critical vendor management challenge – its manual approval processes were putting the business at risk. With key vendors like Google potentially cutting services due to delayed payments, illumin needed a way to better manage vendor relationships.

By using ApprovalMax for vendor management, illumin was able to:

- Prevent service disruptions from key vendors like Google

- Gain visibility into vendor payment terms to schedule payments strategically

- Save 72 hours across 36 approvers every month in vendor invoice processing

- Better manage relationships with vendors through timely approvals

"We can see if things are approved earlier but we don't need to pay it right away. This means we can then schedule payments better too based on the terms of the approved invoices," reports illumin, highlighting how improved vendor management enhances both supplier relationships and cash flow control.

Take control of your accounts payable process

Improving vendor management in accounts payable goes beyond just building trust. It can also help your business become more efficient, improve cash flow, and make sure that financial operations run smoothly.

With ApprovalMax, you can automate approvals, eliminate manual errors, and keep vendor payments on track. Ready to see it in action? Schedule a demo today.

FAQs

What are the best practices for accounts payable vendor management?

- Start with clean vendor records and keep them up to date.

- Automate as much as you can. This is especially useful for onboarding, invoice reviews, and payments.

- Maintain open communication with suppliers to address issues quickly.

What are the future trends in vendor management within accounts payable automation?

We’re seeing more AI-powered tools that can flag potential errors or fraud before they cause problems. Vendor self-service portals are also becoming more common, making it easier for suppliers to upload their details and track their payments. These tools reduce the risk of errors and build a better overall experience for suppliers.

Can AP automation help with compliance and risk management in vendor relationships?

Absolutely. Accounts payable vendor management isn’t just about staying organised, it also protects against risk. Automation tools like ApprovalMax add approval workflows, audit trails, and role-based permissions that help you spot issues early and stay compliant.

How does AP automation help businesses manage multiple vendors efficiently?

It’s easy to lose track of things if you have lots of suppliers. Automation helps you centralise vendor records, smooth out approvals, and clearly see what’s happening in real-time. This way, you stay in control – no matter how many vendors you have.

Can vendor management help me negotiate better contracts or payment terms?

Yes, it can! If you’re known for paying on time and being easy to work with, vendors are more likely to offer discounts, priority service, or flexible terms. Strong vendor management shows you’re a reliable partner and that builds trust over time.

Ready to Simplify Your Approval Process?

Justin Campbell, an experienced accountant with a decade at Xero, blends his deep understanding of finance and technology to simplify processes. He uses his expertise to help businesses work smarter, bringing precision and innovation to every initiative.

Set up a system of checks and balances for your financial operations.

Multi-step, multi-role approval workflows for financial documents.

Auto-generated audit reports for each approved item.

Get alerts for fraudulent activity and protect against it happening.

Leave printing in the past with fully digitised workflows.