Why businesses of all sizes need strong financial controls

Three in four businesses don’t have the right financial controls in place to protect their business; only one-quarter (25%) of businesses report having strong financial controls in place, the research shows. How can businesses of all sizes build better financial controls, especially with the help of their accountants and bookkeepers? We consulted our ApprovalMax experts to learn more:

How do you define financial controls?

Financial controls cover a wide range of internal business controls. They run the whole way through the business finances and encompass checks and balances at various points. They are the things that stop you paying the wrong person or make sure your client has signed off a quote before you start work, and therefore crucial to all businesses.

Why is it so important for businesses of all sizes to have strong financial controls?

Small businesses sometimes think that financial controls aren’t as important to them as for big businesses, but in fact without them an issue can cause bigger issues.

It may be that they don’t need certain areas at the moment, but there will always be controls they do need (such as checking supplier details are correct before payment) and others may come along as their business changes or grows.

How can bookkeepers help their clients to build and maintain these strong controls?

Are there any specific requirements or guidelines around financial controls in the UK?

Whilst there aren’t any specific requirements (as far as I’m aware), having financial controls in place will assist with bits like year end and VAT quarter end processes, as well helping clients internally.

Where do businesses – especially smaller ones – often misstep when it comes to controls?

Smaller businesses often think it’s too complex to document those controls – until something happens, at which point it’s too late.

How do you define financial controls?

Financial controls are the governance around financial management within a business. They’re checks and balances put in place to ensure there is integrity around a businesses’ financial data, processes, and output.

Why is it so important for businesses of all sizes to have strong financial controls?

Ensuring that you have integrity around your financial information is critical, particularly if you’re needing to provide that to other stakeholders or selling a business. For example, are you buying a business, seeking financing, or do you have Australian Taxation Office or other legal compliance obligations? It even extends further out to things like marriage breakdowns.

Financial controls are also vital for fraud mitigation. In businesses there can be a fine line between success and failure; you want to protect the financial resources of that business from any misappropriation or mishandling, whether intentional or not.

How can bookkeepers support their clients to build and maintain these controls?

As bookkeepers, we’re very deeply embedded in the day-to-day mechanics of business operations and that gives us unique insights into workflows, processes, and procedures. Through this, we have the ability to spot where there are weaknesses or flaws in those processes, as well as the capacity to work with business owners to try and fix those gaps.

With EOFY soon approaching in Australia, is this the best time to set up financial controls?

Yes it’s an opportunity, but tomorrow is an opportunity as well. While the new financial year is always a good refresh, there’s nothing that stops people from doing it immediately! If you wait, there’s always the risk that you’ll get distracted and never get it done.

How do you define financial controls?

They are ultimately controls that safeguard cash, whether this is directly in terms of peoples bank access or more indirectly, such as approval processes for purchase orders.

Why is it so important for businesses of all sizes to have strong financial controls?

Financial controls serve several purposes. They help stop worst case scenarios, whether that be because of fraud or simply poor spending decisions.

Financial controls also help maximise the use of your money. You’d be amazed how much money can be wasted without the right controls in place. A prime example is on subscriptions set up that are never used but not cancelled.

How can bookkeepers help their clients to build and maintain these strong controls?

Accountants are in a prime position to help build controls. They have a great grasp of finances so can help develop processes around purchases and sales as a starting point.

Accountants can also play the enforcer role in a firm, making sure processes are followed, which some business owners may feel uncomfortable with.

Where do businesses – especially smaller ones – often misstep when it comes to controls?

They probably put too much trust in people over processes to be honest and they often move so quickly that controls get neglected. In the worst case, this puts you at risk financially.

It also means so much more time needs to be spent building controls down the line which can be messy the more people are involved. It’s much easier to build solid foundations from day one!

Are there any examples, like with your own clients, where you’ve seen first-hand the benefits of stronger controls?

We saved a client over £10k over a six month period by bringing in a robust purchase order system. Previously he was paying for stuff that never arrived!

How do you define financial controls?

Financial controls are the safeguards you put in place to protect your money.

Why is it so important for businesses of all sizes to have strong financial controls?

There are so many ways that money can be deliberately and accidentally misappropriated. It’s important to protect yourself and mitigate those risks to succeed in business.

Do smaller businesses often have fewer financial controls in place?

Yes. Just look at sole traders – the controls are the fact that they are across everything. But once they start to grow, that’s where the challenges arise, because you go from no financial controls except for you, but now all of a sudden you’ve invited other people into your house, they’ve all got a key, and the doors are wide open. To me, that’s what financial controls are, letting people in but only into certain rooms of the house.

Where do businesses – especially smaller ones – often misstep when it comes to controls?

The biggest mistake I see is access to the bank account. I’ve seen multiple business owners provide their bookkeeper or accountant signatory access to the bank account, often where it’s one to sign.

Are there any examples, like with your own clients, where you’ve seen first-hand the benefits of stronger controls?

A client once checked the bank details for an invoice and figured out that it was a scam – it had been intercepted and the account numbers changed, but thankfully they picked it up. I’ve had other clients without those controls in place and had paid money to the wrong supplier.

Why is it so important for businesses of all sizes to have strong financial controls?

Strong financial controls are the guardrails of good decision-making in any business. A lot of smaller companies may hear the term ‘financial controls’ and think ‘that’s not for me, my company isn’t big enough. But no matter the size, every business has something to protect and no one wants to lose money to fraud or carelessness.

How can accountants help their clients to build and maintain these strong controls?

As trusted advisors, accountants not only provide services but valuable education. Many small business accountants can help clients design, monitor, and adjust financial controls as circumstances change and their business evolves. It doesn’t have to be a huge project to deliver a full playbook of financial policies and procedures – simply asking questions like ‘How are you protecting your business from phishing emails?’ can highlight potential risks.

Are there any specific requirements or guidelines around financial controls in North America, where you’re based?

Across North America, guidelines around financial controls vary. Companies operating in the US capital markets are subject to the Sarbanes Oxley Act (SOX) and all companies listed in Canada are subject to Bill 198 (unofficially “C-SOX”).

Where do businesses – especially smaller ones – often misstep when it comes to controls?

Some small businesses misstep when it comes to financial controls by simply copying the financial controls of another company without assessing what will work for them, or where their own areas of risk are. If you find your team is always processing exceptions to the guidelines, they weren’t customised enough for your unique ways of operating – or you’ve outgrown them!

Download our latest guide to learn more about tightening your financial controls for Xero users.

Approvalmax is an all-in-one B2B software platform used by businesses around the world to build robust AP and AR automation, creating multiple layers of internal control. It streamlines the approval process by allowing users to create automated workflows to approve bills and invoices. ApprovalMax integrates with accounting platforms such as Xero, QuickBooks Online, and Oracle NetSuite to unlock powerful efficiencies for accounts payable and accounts receivable functions in any finance team.

Set up a system of checks and balances for your financial operations.

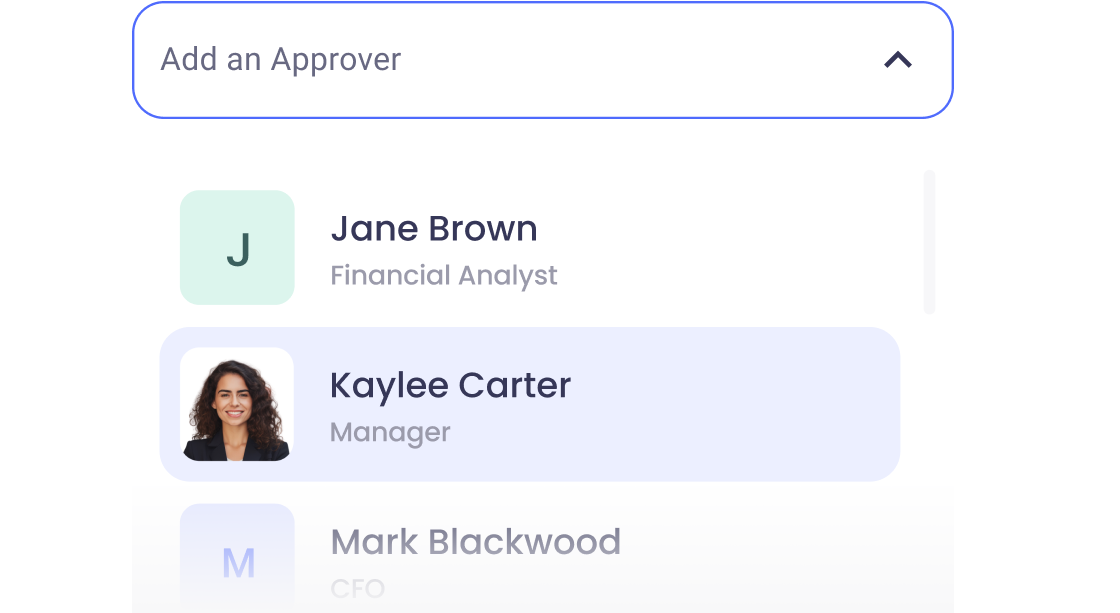

Multi-step, multi-role approval workflows for financial documents.

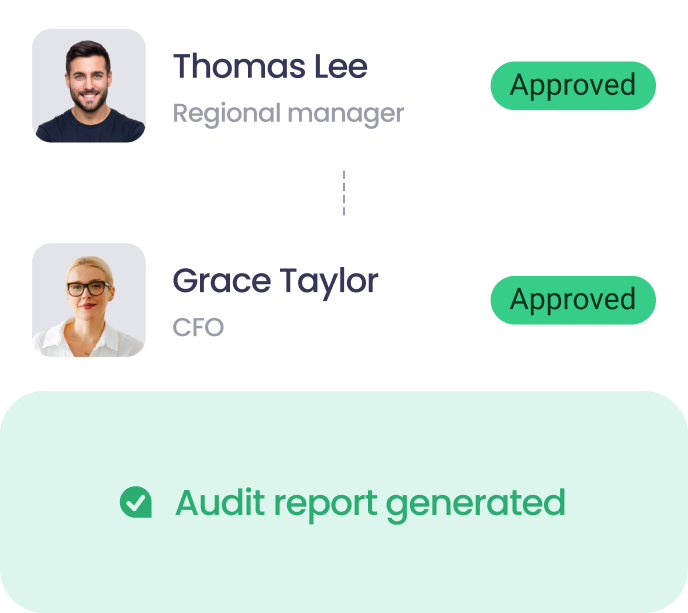

Auto-generated audit reports for each approved item.

Get alerts for fraudulent activity and protect against it happening.

Leave printing in the past with fully digitised workflows.