Accounts payable audit: A complete guide

- What is an accounts payable audit?

- Internal vs external AP audits

- Why conduct an AP audit?

- Key objectives of an accounts payable audit

- Preparing for an accounts payable audit

- Accounts payable audit checklist

- How to audit accounts payable internally

- Common issues identified during AP audits

- Best practices for accounts payable auditing

- How AP automation improves accounts payable audits

- FAQs

Accounts payable (AP) audits are a crucial tool to help protect your business. Regular AP audits check everything is how it’s meant to be, from POs and expenses to payments; this keeps cash flow steady, improves vendor relationships and reduce the risk of fraud. Given 79% of companies experienced attempted fraud in the last year alone, it’s critical to have the right processes in place to detect fraud – and even prevent it from happening..

In this guide, we’ll walk you through everything you need to know about accounts payable audits, including:

- What AP audits are and why they matter

- How to prepare for one

- Common issues to watch out for

- How automation makes the process easier and more reliable

What is an accounts payable audit?

An accounts payable audit is a structured review of your accounts payable records and processes. These audits are designed to:

- Verify the accuracy of your financial data

- Check that controls are working properly

- Make sure your business is following appropriate accounting standards.

AP audits can be carried out internally by your finance team or externally as part of a formal financial audit.

Ultimately, the purpose of an accounts payable audit is to:

- Find and remove any risks or errors

- Build trust with stakeholders

- Support better financial decisions for your company

Internal vs external AP audits – What’s the difference?

An internal AP audit is carried out by your finance team or internal auditors. This process improves the overall efficiency of your AP by uncovering issues or flaws. An external audit is conducted by third-party auditors to verify the accuracy of financial statements.

In this guide, we’ll focus on internal AP audits.

Why conduct an AP audit?

An accounts payable audit is a valuable way to:

- Identify and reduce risks

- Detect fraud or unusual transactions early

- Improve compliance with internal policies and industry regulations

- Make sure records are accurate and up to date

- Build confidence in your financial statements ahead of external audits

But AP audits are more than a compliance exercise; they’re an invaluable tool for making smarter financial decisions.

Key objectives of an accounts payable audit

A strong accounts payable audit should start with four key objectives:

-

Completeness: Check that all liabilities, especially those near to reporting deadlines, are fully recorded. This gives you a clear picture of what’s owed.

-

Validity: Confirm every payable is genuine and tied to goods or services you’ve received. This helps prevent fraud and duplicate payments.

-

Compliance: Make sure transactions follow company policies and accounting standards. This reduces risk and strengthens controls.

-

Disclosure: Check payables are clearly shown in financial reports. This keeps things transparent for auditors and stakeholders.

Preparing for an accounts payable audit

Who should be involved in the audit process?

The size of your business should determine who to involve. Smaller businesses often involve one or two people, while larger organisations may need a larger, structured team.

Documents & data needed for AP audit

Gather the following documents in preparation for your audit:

- Invoice records

- Purchase orders

- Payment confirmations

- Vendor master files

- General ledger entries

- Approval logs

- Reconciliation reports

- Audit trails (from AP automation tools)

Automating this process makes it easier to gather and share data, avoiding unnecessary delays.

What auditors look for in an AP audit

Auditors are focused on the accuracy, consistency and integrity of your accounts payable process. They often look for:

-

Accuracy and completeness of transactions: Are invoices, payments, and adjustments properly recorded and reflected in your ledgers?

-

Proper approvals and documentation: Does every transaction follow your company’s internal approval workflows? Is there clear documentation to support each payment?

-

Matching between invoices, POs, and payments (3-way matching): Are your invoices, purchase orders and payments correctly linked for consistency?

-

Segregation of duties: Is your process designed to prevent one individual from having too much control over approvals and payments?

-

Signs of fraud or process gaps: Are there any duplicate payments, suspicious vendors or unusual payment patterns that could indicate bigger issues?

Accounts payable audit checklist

Now that you know what auditors look for, use this checklist to make sure your accounts payable audit is complete and accurate.

Switch to a paperless AP process to reduce stress and improve audit-readiness.

Step-by-Step: How to audit accounts payable internally

Common issues identified during AP audits

Here are a few common issues to look out for during your accounts payable audit:

- Duplicate payments

- Missing documentation

- Lack of approvals

- Poor segregation of duties

- Inaccurate records

- Unreconciled balances

- Payments made without purchase orders

- Fraudulent or unauthorised transactions

Best practices for accounts payable auditing

To help you stay ahead of these issues, here are some best practices to follow:

- Set up clear, standardised workflows

- Maintain digital records for easy access

- Enforce segregation of duties

- Conduct regular internal reviews

- Automate approvals where possible

- Keep audit trails organised and accessible

- Train staff regularly on policies and procedures

- Maintain positive relationships with vendors

How AP automation improves accounts payable audits

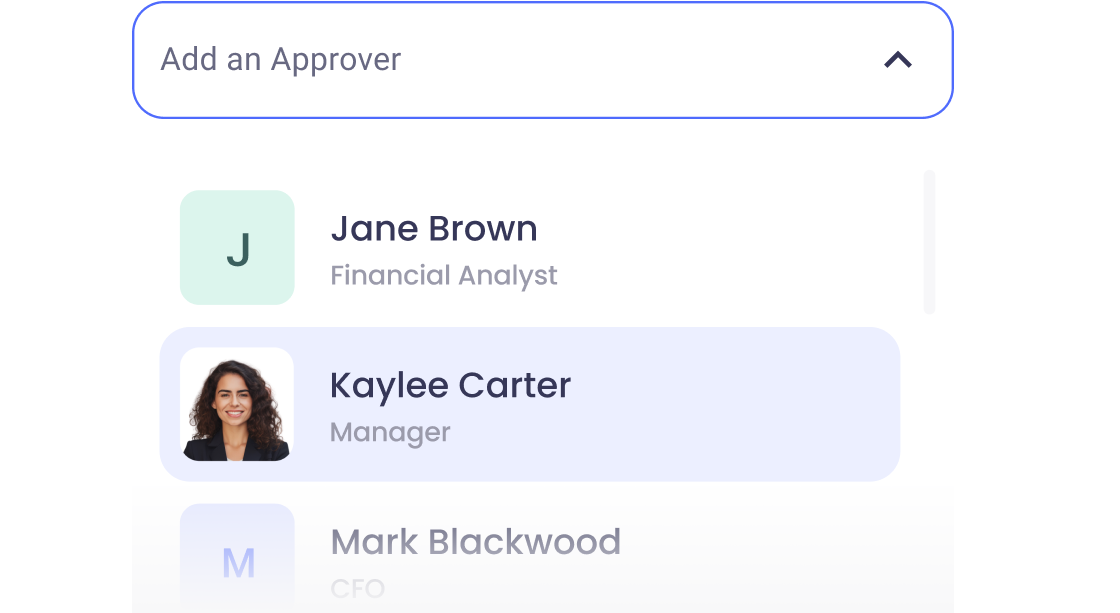

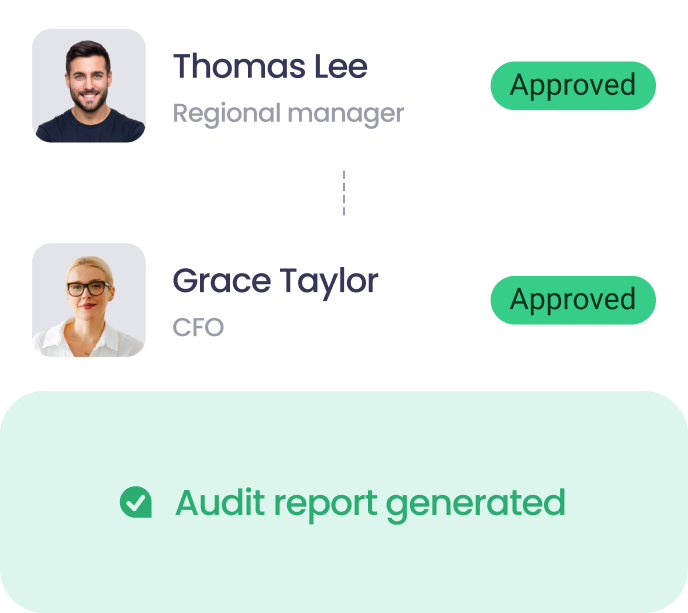

Automation tools like ApprovalMax take the stress out of accounts payable audits. Simplify the entire process with automated approval workflows, built-in audit trails, and real-time visibility. Whether you want to reduce errors, speed up approvals, or prepare for your next audit, ApprovalMax helps you stay in control.

Our software integrates with Xero, QuickBooks and NetSuite, keeping your data accurate and your processes straightforward.

FAQs

What triggers an AP audit?

Routine financial reviews, red flags like fraud risks, or preparation for external audits often trigger AP audits.

How often should we audit accounts payable?

Most businesses conduct an AP audit annually. Larger teams may prefer quarterly reviews for additional oversight.

What’s the difference between an AP audit and an AP reconciliation?

An AP reconciliation checks balances at a point in time, while an audit reviews the full process for accuracy, compliance and risk.

Can AP automation reduce audit risk?

Absolutely! Automation improves accuracy and provides detailed audit trails. It also supports compliance and speeds up reporting.

Ready to Simplify Your Approval Process?

Justin Campbell, an experienced accountant with a decade at Xero, blends his deep understanding of finance and technology to simplify processes. He uses his expertise to help businesses work smarter, bringing precision and innovation to every initiative.

Set up a system of checks and balances for your financial operations.

Multi-step, multi-role approval workflows for financial documents.

Auto-generated audit reports for each approved item.

Get alerts for fraudulent activity and protect against it happening.

Leave printing in the past with fully digitised workflows.