When to outsource accounts receivable and what to expect

- What is accounts receivable outsourcing?

- How AR outsourcing works

- Key benefits

- Common challenges

- When it makes sense to outsource AR

- How to choose the right AR outsourcing partner

- Metrics to measure outsourcing success

- Risks and compliance considerations

- Outsourcing vs. automation

- How AR outsourcing connects to the bigger picture

- The role of automation

- Getting started with automation

- FAQs

Cash flow keeps a business alive, but late payments and manual invoicing can quickly slow it down. When finance teams spend their days chasing invoices instead of managing performance, something has to change.

Accounts receivable outsourcing helps by handing invoicing, reminders, and collections to specialists. It saves time, reduces errors, and gives your team space to focus on smarter decisions.

With the right provider, outsourcing brings structure and visibility to your cash flow. And when paired with automation, it turns collections into a consistent, data-driven process instead of a monthly scramble.

In this guide, you’ll learn what AR outsourcing is, how it works with automation, and when it’s the right move for your business.

• AR outsourcing reduces manual workloads and improves cash flow visibility.

• Regular reporting and analytics turn AR from a reactive task into a predictable process.

• Clear performance metrics such as DSO and dispute rates keep outsourcing accountable.

• Combining outsourcing and automation improves accuracy and control.

• Connecting AR and AP outsourcing provides a full view of cash movement and control.

What is accounts receivable outsourcing

Accounts receivable outsourcing means bringing in a specialist team to handle invoicing, payment follow-ups, and collections on your behalf. It takes the routine, time-consuming tasks off your finance team’s plate and keeps cash flowing without the constant chase.

An outsourcing partner typically manages:

- Invoice creation and distribution

- Payment tracking and reminders

- Collections and dispute handling

- Cash application and reconciliation

- Reporting and performance insights

By handing off these daily AR activities, finance leaders gain more time for forecasting, analysis, and strategic work that actually moves the business forward.

How accounts receivable outsourcing works

Outsourcing your accounts receivable process does not mean losing control. It means creating a structured and reliable system for how money comes in.

Here’s what that usually looks like:

A good provider should integrate smoothly with your existing accounting software like Xero and QuickBooks. Automation can also support the process by handling approval flows, matching payments and flagging exceptions.

This way, you spend less time chasing payments or fixing errors, and more time analysing results.

Key benefits of outsourcing accounts receivable

Outsourcing accounts receivable brings both time savings and measurable financial benefits.

Here's a list of benefits of AR outsourcing:

By outsourcing, finance leaders gain space to think ahead rather than react. The process becomes consistent, predictable, and backed by technology that keeps the business moving forward.

Common challenges and how to overcome them

Outsourcing can make your AR process more efficient, but it also introduces new responsibilities. The key is to keep visibility, security, and communication in check so you gain support without losing control.

Loss of control or visibility

Worried you’ll lose touch with your AR process? Define strong service level agreements (SLAs), insist on real-time dashboards and make sure you still access the KPIs you care about.

Data security concerns

Before handing over sensitive data, make sure your provider has recognised certifications (for example, SOC 2, GDPR compliance) and you keep clear contracts around data access.

Communication and time-zone barriers

If your provider is remote or offshore, delays and miscommunications can emerge. Build clear communication channels, regular review calls and escalation paths.

Customer relationship impact

Your brand tone matters when someone else does your collections. Ask your provider to match your tone, provide scripts or templates and monitor how they handle your customers.

When it makes sense to outsource AR

- Your invoice volume is growing rapidly or your DSO is increasing.

- You struggle to recruit or retain AR expertise internally.

- You’re expanding internationally and need multilingual or 24/7 coverage.

- You want to combine automation and expert oversight rather than purely internal manual work.

For example, a manufacturing firm dealing with overseas clients might outsource AR to handle multilingual reminders and global payments. You might also consider a hybrid model to keep invoice creation in-house.

How to choose the right accounts receivable outsourcing partner

The right partner can make or break your outsourcing success. Here are seven key things to look for:

- Experience in your industry (for example SaaS, manufacturing, retail)

- Proven track-record of improving cash collection or reducing DSO

- Integration with your accounting/ERP platforms (Xero, QuickBooks, NetSuite.

- Strong security and compliance credentials (SOC 2, GDPR, PCI-DSS where relevant).

- Transparent reporting and dashboards (real-time KPIs, DSO metrics, aging).

- A clear pricing model (per invoice, retainer, performance-based).

- Defined communication cadence and escalation process (weekly/bi-weekly reviews).

Watch out for hidden or unpredictable fees, no clear performance KPIs and a lack of data transparency.

Metrics to measure outsourcing success

Once you’ve decided to outsource AR, it’s important to track the following metrics to measure its success.

Review these KPIs quarterly with your provider to keep performance aligned and stay in control.

Risks and compliance considerations

It’s also important to maintain control and compliance by:

- Making sure data is handled under GDPR, SOC 2 and PCI-DSS (if relevant).

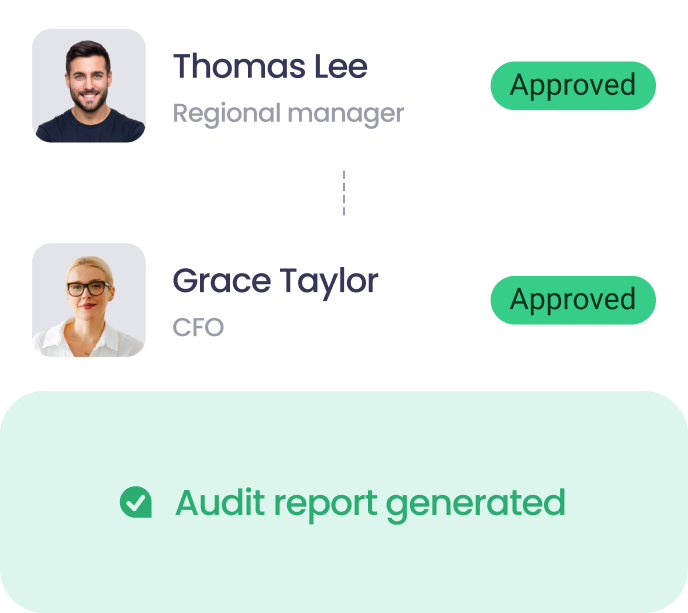

- Demanding a full audit-trail, logs and documentation of each invoice and payment.

- Segregating duties to avoid the same party handling everything end-to-end unchecked.

- Mitigating vendor risk by using NDAs, well-defined SLAs, exit clauses and performance-based contracts.

Outsourcing vs. automation: what’s the better long-term strategy

Use our comparison table below to see what’s best for your organisation.

A hybrid model works best for most businesses since it offers the best of both worlds: automation for scale and outsourcing for expertise.

How accounts receivable outsourcing connects to the bigger picture

Outsourcing accounts receivable improves how cash comes into the business, while accounts payable outsourcing manages how it flows out. Together, they help finance teams balance inflows and outflows, reduce delays and get a clearer view of working capital.

But even with both sides outsourced, teams still rely on manual updates and periodic reports. Automation changes that by connecting receivables and payables in real time, giving finance teams live visibility across the entire cash cycle.

The role of automation in modern AR outsourcing

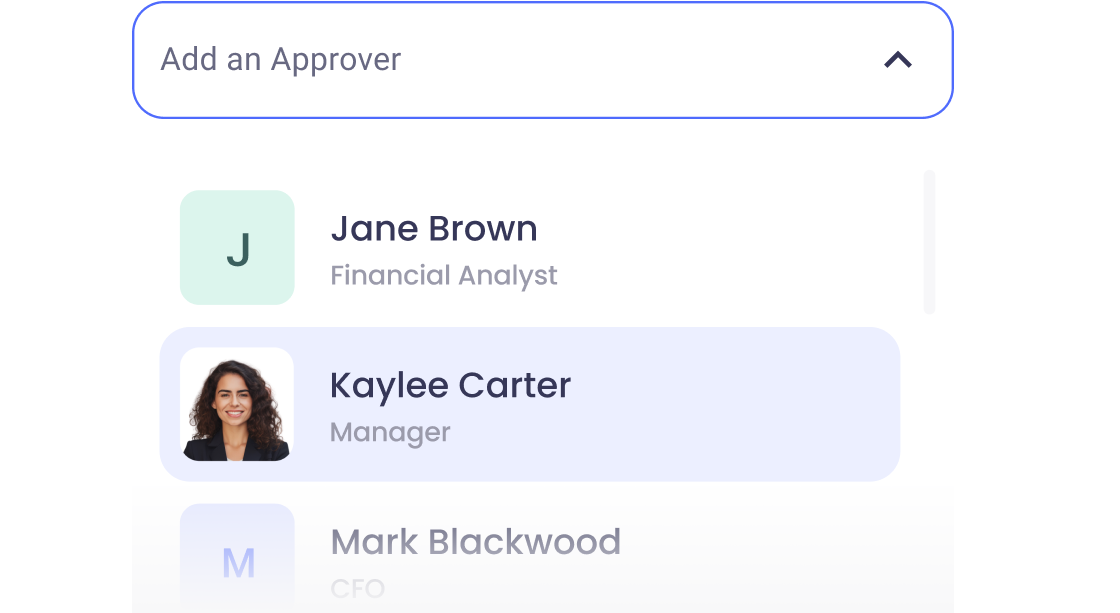

Automation handles repetitive tasks like sending reminders, matching payments and reconciling accounts. For example, ApprovalMax integrates with Xero and QuickBooks to automate approval flows and enforce control. Meanwhile, human experts handle exceptions, disputes and strategic follow-up.

When you pair automation with outsourcing, you improve speed, accuracy, and compliance. In fact, Stripe reports that automation gives teams 60% more visibility into outstanding invoices and cash flow forecasting. On top of this, manual AR teams spend around 10 hours per week chasing payments. Automation cuts that by more than half.

Getting started with automation

If your AR process is slowing you down, outsourcing makes a real difference. It improves efficiency, reduces DSO and frees your finance team for high-value work. When you pair outsourcing with automation, you gain speed, accuracy and control.

If you’re ready to update your AR process, start your 14-day free trial to see how ApprovalMax works alongside outsourcing to automate approvals for invoices, credit notes and sales orders in Xero, QuickBooks, and NetSuite.

FAQs

Can I outsource AR and still use my existing accounting software?

Yes. Most AR outsourcing providers work directly within your existing systems like Xero, QuickBooks, or NetSuite. You stay in control while they handle the daily work.

Which parts of AR can be automated when outsourced?

Invoice creation, reminders, payment tracking, cash application, and reporting can all be automated. People still handle exceptions, disputes, and customer communication.

Is AR outsourcing suitable for small businesses?

Yes. It works well for small teams that do not have a full AR department. Just make sure the cost fits your volume and that you keep full visibility over the process.

What is the main purpose of AR outsourcing?

To free your finance team from manual invoicing and collections while improving cash flow, accuracy, and reporting consistency.

How much does accounts receivable outsourcing cost?

Costs vary by volume and scope. Most providers charge per invoice or a monthly fee, usually cheaper than hiring in-house and often saving 30 to 50 percent of total AR costs.

Can I outsource part of my AR process?

Yes. Many companies outsource only routine tasks such as reminders and reconciliation while keeping client relationships and approvals in-house.

Ready to Simplify Your Approval Process?

Justin Campbell, an experienced accountant with a decade at Xero, blends his deep understanding of finance and technology to simplify processes. He uses his expertise to help businesses work smarter, bringing precision and innovation to every initiative.

Set up a system of checks and balances for your financial operations.

Multi-step, multi-role approval workflows for financial documents.

Auto-generated audit reports for each approved item.

Get alerts for fraudulent activity and protect against it happening.

Leave printing in the past with fully digitised workflows.