Product News

More customer stories

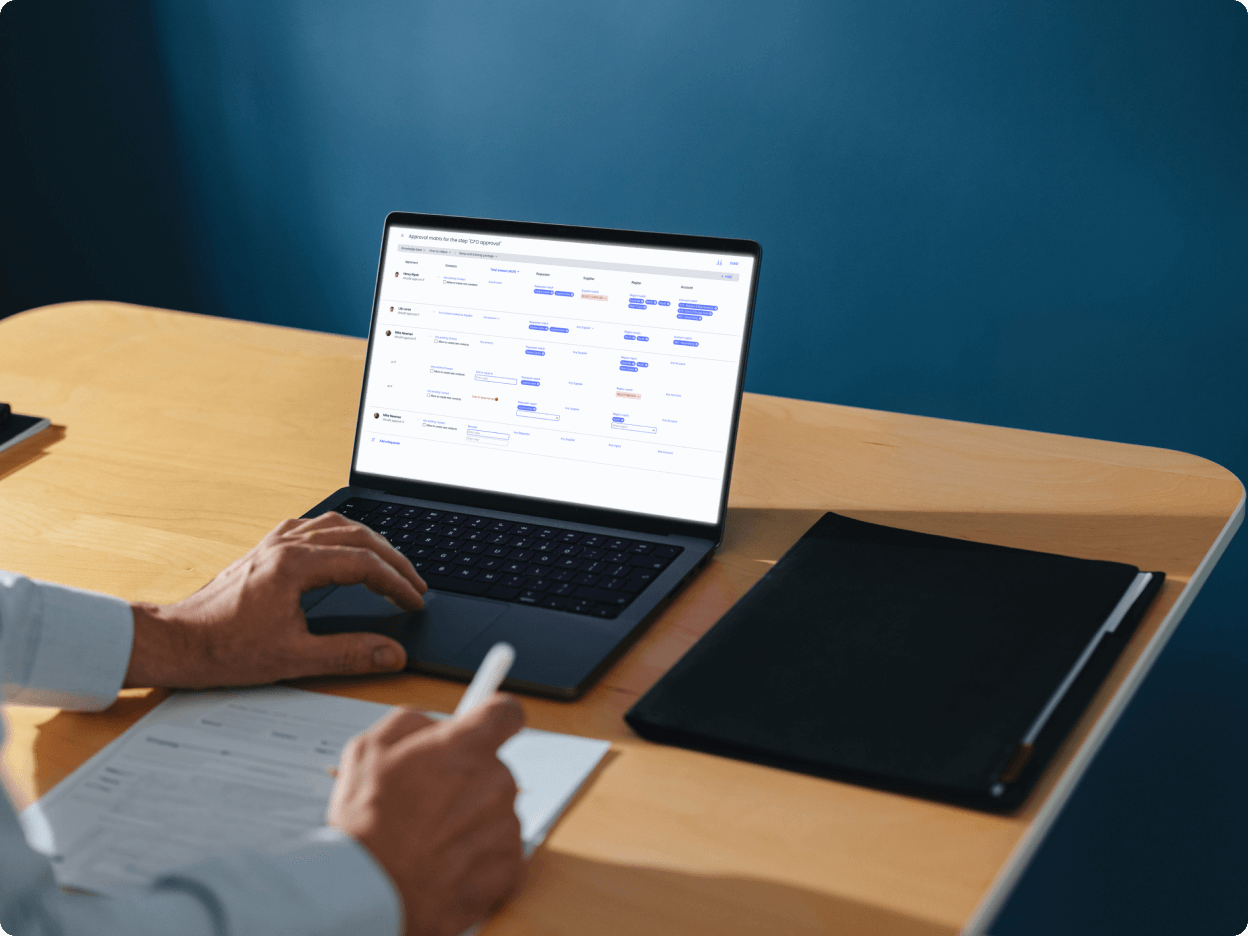

Yoco automates complex approvals to move at speed

Learn how fintech company Yoco uses ApprovalMax to automate sophisticated approval workflows with ease and build strong processes for fast growth...

How Le Contrôleur used automation to reinvent remote approvals

Lead text here The financial controllers, bookkeepers, and CPAs that work at Le Contrôleur are so focused on relationships ...

How an advisory firm helped their client save $40k with ApprovalMax

Learn how by working with Tinka Consulting and implementing ApprovalMax, NOUS was able to improve the efficiency and transparency of ...

Ready to simplify your approval process?